Image via Wikipedia

Image via Wikipedia

Better economic growth will see wages rise as well. Volume growth has been slower in recent quarters and steep price hikes that aided growth in fiscal 2009 and early fiscal 2010 are history

This year’s Budget will hold much interest for investors in consumer sectors such as home, personal care and food products. On the cost front, a sharp jump in food prices and rising inflation in other manufactured products has seen costs increase.

In addition, advertising as a percentage of sales seems to have permanently moved to a higher level. Better economic growth will see wages rise as well. Volume growth has been slower in recent quarters and steep price hikes that aided growth in fiscal 2009 and early fiscal 2010 are history. Large players have had to keep prices in check to hold on to their market shares even if their operating margins suffer in the near term.

Watch videos, play the budget game, and find out how the budget affects you. All that and more on Livemint.com’s exclusive Budget 2010 microsite

Another consumer sector that attracts investor interest is organized retail, in which the large listed players are seeing their revenue and profits growing again. Retailers have become more realistic about their expansion plans, focusing on sustainable growth, and lower rentals and operating costs have helped improve margins.

Graphic: Yogesh Kumar / Mint

Graphic: Yogesh Kumar / Mint

What could the Budget hold for investors in these sectors? A roll-back in indirect taxes, by about 2-3 percentage points, is on the cards. Most consumer goods companies have factories in excise-exempt locations. The impact will be limited to the extent of production in other locations. In addition, companies claim credit on taxes paid on inputs. So the net impact will be lower. In the past, the government has occasionally hiked duties on cigarettes when faced with a revenue shortfall. A similar move in this Budget will have a short-term effect on their shares. ITC Ltd has shown the ability to pass higher taxes to customers, with little impact on consumption in the longer run. Market sentiment for the stock, however, may sour in the near term, depending on the quantum of hike.

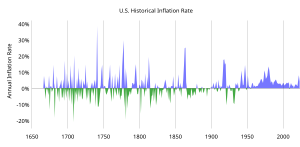

The effect of higher levies could be offset by measures taken to counter the effect of rising inflation, especially in food. Rural demand for consumer goods received a boost after the government’s social sector schemes saw disposable income rise. But food inflation is eating into rural budgets. This effect is being noticed even in mass categories in urban areas. Any specific measures to ease the burden of inflation on consumers will be welcomed by investors.

The Budget proposals are likely to have a neutral to negative impact on the sector, depending on the extent of hikes in taxes proposed by the government to increase revenues. Any retail sector-specific measures are not expected, unless allowing foreign direct investment in multi-brand retail formats is taken up. An announcement on a new deadline to introducing a common goods and services tax by

Source: http://www.livemint.com/2010/02/23232719/Consumer-sector-may-gain-littl.html

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=5bd24375-98fb-4d8f-9d42-a730101dd6d5)

0 comments:

Post a Comment